News

HCHS completes installation of state-of-the-art access control system

Harlan County Schools Superintendent Brent Roark and Harlan County High School Principal Kathy Napier have announced the implementation ...

Harlan County Schools Superintendent Brent Roark and Harlan County High School Principal Kathy Napier have announced the implementation ...

The Harlan County Fiscal Court heard the annual budget report from the Harlan County Soil Conservation during the ...

The Harlan Independent School District is currently seeing new construction and upgrades at the Joe Gilley Athletic Complex, ...

The Harlan Civic Center will be the location for the first Guardian Angels event on Wednesday, April 24, ...

A Harlan County woman is facing multiple charges including possession of methamphetamine and heroin after allegedly being found ...

The Kentucky Department of Fish and Wildlife Resources will host its semi-annual live auction to sell surplus items ...

The Department of the Interior announced Wednesday the awarding of $36.9 million in the first phase of formula ...

YahooSports NBA draft analyst Krysten Peek has Kentucky guard Reed Sheppard going No. 6 in the NBA draft ...

By Billy Holland Columnist Have you considered that most individuals are convinced that what they believe is true, ...

YahooSports NBA draft analyst Krysten Peek has Kentucky guard Reed Sheppard going No. 6 in the NBA draft ...

The Kentucky Transportation Cabinet (KYTC) reminds political candidates, residents, business operators and property owners along US and KY ...

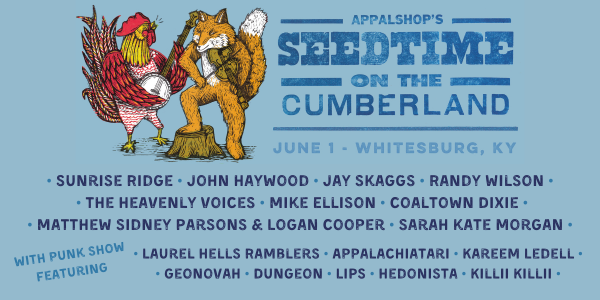

Kentucky Lantern Appalshop has announced the lineup for Seedtime on the Cumberland June 1 in Whitesburg. The free ...

By Jack Godbey Columnist It seems that everyone has a cell phone. I even saw a panhandler standing ...

Orville Yeary, 84, of Ages died April 22, 2024. Services by Evarts Funeral Home.

A week after he replaced John Calipari at Kentucky, Mark Pope made his first post on social media, ...

By Steve Roark Contributing Writer Wild ginger (Asarum canadense) is an interesting plant found in rich, moist, ...

Kentucky’s seasonally adjusted preliminary March 2024 unemployment rate was 4.5 percent, according to data released Thursday by the ...

Average gasoline prices in Kentucky have fallen 1.8 cents per gallon in the last week, averaging $3.30/g today, ...

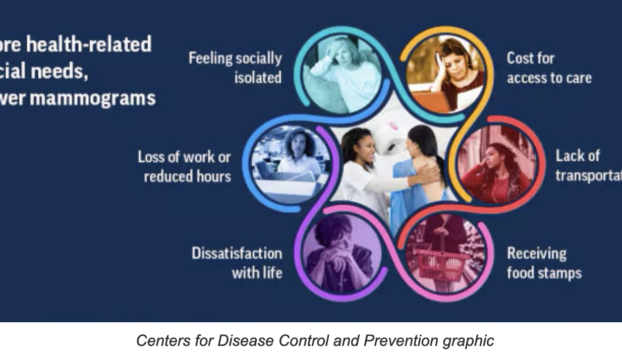

A Centers for Disease Control and Prevention study says the more health-related social needs a woman has, the ...

Kentucky State Parks continue to celebrate their 100th anniversary with a series of events in April. Cumberland Falls ...

By Claire Sawyers Contributing Writer Nostalgia is a beautiful, yet saddening experience that calls upon long-forgotten memories and ...

Reed Sheppard is ready to pursue his next dream. The Kentucky freshman guard declared for the NBA Draft ...

Compiled by Paul Lunsford. Marriage Licenses Annette Halcomb, 43, of Coldiron, to Erica A. Mandrell, 42, of Coldiron. ...

Harlan County residents, organizations and businesses can help reward the area’s best and brightest students for their academic ...

By Dave Ramsey Syndicated Columnist Dear Dave, I have a roommate, and we’ve shared the same two-bedroom ...