News

Harlan Center to host Guardian Angels event

The Harlan Civic Center will be the location for the first Guardian Angels event on Wednesday, April 24, ...

The Harlan Civic Center will be the location for the first Guardian Angels event on Wednesday, April 24, ...

A Harlan County woman is facing multiple charges including possession of methamphetamine and heroin after allegedly being found ...

Harlan County residents, organizations and businesses can help reward the area’s best and brightest students for their academic ...

Harlan now has a new option for those in need of dental care. Leisge Dental held a grand ...

The Harlan City Council heard a progress report on action being taken by the city concerning a blighted ...

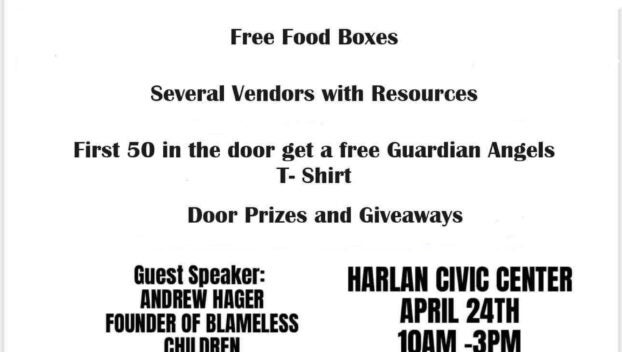

A Centers for Disease Control and Prevention study says the more health-related social needs a woman has, the ...

Kentucky State Parks continue to celebrate their 100th anniversary with a series of events in April. Cumberland Falls ...

By Claire Sawyers Contributing Writer Nostalgia is a beautiful, yet saddening experience that calls upon long-forgotten memories and ...

Reed Sheppard is ready to pursue his next dream. The Kentucky freshman guard declared for the NBA Draft ...

Compiled by Paul Lunsford. Marriage Licenses Annette Halcomb, 43, of Coldiron, to Erica A. Mandrell, 42, of Coldiron. ...

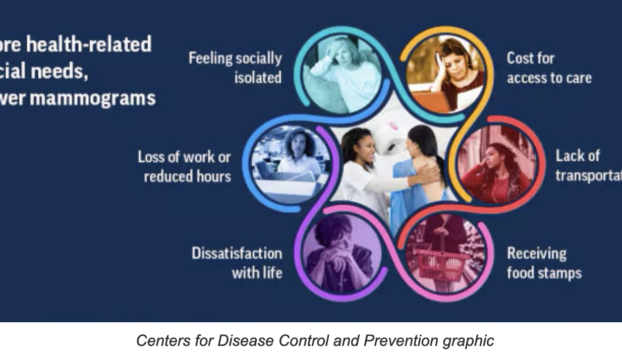

By Dave Ramsey Syndicated Columnist Dear Dave, I have a roommate, and we’ve shared the same two-bedroom ...

A Kentucky death row inmate, who pleaded guilty in 1998 of murdering a teenage girl in Caldwell Circuit ...

The U.S. Food and Drug Administration (FDA) along with the Centers for Disease Control and Prevention (CDC) are ...

This hasn’t been a typical season for Louisville’s baseball team, and it got worse Tuesday night, leaving coach ...

By Billy Holland Columnist The older we are, the more we can see how the world has ...

Vince Marrow still remembers the doubts many had when he arrived at Kentucky with new coach Mark Stoops ...

Secretary of State Michael Adams, in his role as Kentucky’s Chief Election Officer, is reminding everyone that the ...

It was quiet in the House and Senate chambers on Tuesday, as members of the General Assembly wrapped ...

By McKenna Horsley Kentucky Lantern The Kentucky Senate has confirmed the next commissioner of education after giving him ...

The Kentucky State Police (KSP) are partnering with Special Olympics Kentucky to “Cover the Cruiser,” April 19-26, as ...

Former University of Kentucky point guard Anthony Epps admits he was “very excited” when UK named Mark Pope, ...

By Jack Godbey Columnist Sometimes there are things we go through that only a cheeseburger will fix. My ...

The curtain goes up at the Harlan County High School theater this week for “Ghost House,” a dark ...

By John Henson Contributing Sports Writer Brought to you by our partners at Harlan County Sports. After watching ...

By John Henson Contributing Sports Writer Brought to you by our partners at Harlan County Sports. Even though ...