News

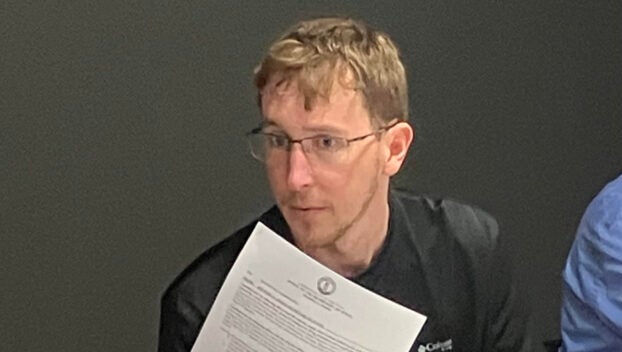

Harlan council reappoints Housing Authority Board members

The Harlan City Council held their regular meeting on Monday, April, 9, addressing topics including the reappointment of ...

The Harlan City Council held their regular meeting on Monday, April, 9, addressing topics including the reappointment of ...

Kingdom Come State Park’s 8th annual Raven Rock 5K Trail Run is set for 10 a.m. on Saturday, ...

The annual Lillian Faye Simpson Golf Classic, a scramble style golf tournament held to raise funds for scholarships ...

A large segment of North America found itself in the path of a total solar eclipse on Monday, ...

Harlan County High School hosted a team of dignitaries from the Lighthouse Beacon Foundation and the University of ...

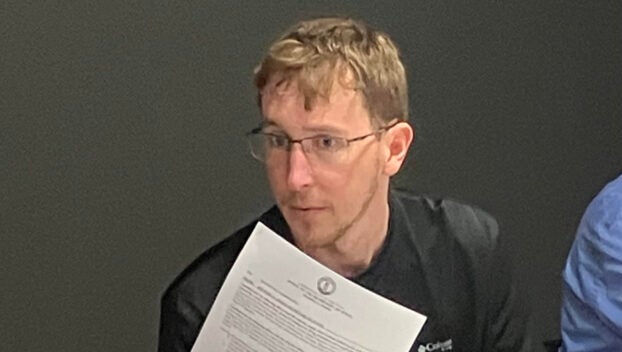

By Dave Ramsey Columnist Dear Dave, My husband and I are in a bad situation, and we’re ...

Kentucky turned to one of its own to coach the Wildcats. Mark Pope, a former player and most ...

Compiled by Paul Lunsford. Britt Anglian, 43, second-degree criminal trespassing, theft by unlawful taking — continued for arraignment. ...

By Sarah Boggs Columnist Do you think that we have an end in life that is unchangeable? I ...

By Tom Latek Kentucky Today Registration renewals typically sent in March to applicable Kentucky vehicle owners have been ...

More than 250 Kentucky child care providers responsible for 150,000 children across the state sent lawmakers a letter ...

By Jack Godbey Columnist Sometimes when you get a craving, you just have to give in to it. ...

Soon, former University of Kentucky legend Tim Couch will be inducted into the College Football Hall of Fame. ...

Southeast Kentucky Community and Technical College (SKCTC) welcomed Dr. Ryan Quarles, president of the Kentucky Community & Technical ...

By Billy Holland Columnist We all know the feeling of having something on our minds that we have ...

The owner of a Northern Kentucky car dealership will be spending the next 18 years in prison after ...

Kentucky Lantern A bill that open government advocates warn would introduce loopholes into Kentucky’s open records law could ...

After she became the first American to win an Olympic gold medal in fencing during the Olympics in ...

Average gasoline prices in Kentucky have risen 18.4 cents per gallon in the last week, averaging $3.39/g today, ...

Staff Report Brought to you by our partners at Harlan County Sports. Harlan (4-7) split two games Saturday ...

The John Calipari era is over at Kentucky. Calipari announced his resignation in a video posted Tuesday on ...

By Samantha Mills Bluegrass Newsmedia According to the American Heartworm Society, more than one million pets in the ...

Brought to you by our partners at Harlan County Sports. Harlan County suffered four losses during a spring ...

Brought to you by our partners, Harlan County Sports. Tucker Napier, a sophomore, pitched a two-hitter and allowed ...

By Steve Roark Columnist One of the most beautiful wildflowers to see in the Spring are trilliums, which ...